Can I live in Japan with X yen salary?

Main photo original here.

On Quora.com, I see almost on a weekly basis a question along the following lines: –

Can I live in Japan on a monthly/yearly salary of X?

Loads of people on Quora.com

There tends to be some conditions added on occasion, such as with a wife and/or kids, or living in a specific city or area. However, in general the only criteria that seems to change per question, is the salary.

Instead of writing a reply for every small increment of salary, I thought it better to write a comprehensive guide so you can figure it out for yourself.

What is an “average” salary in Japan?

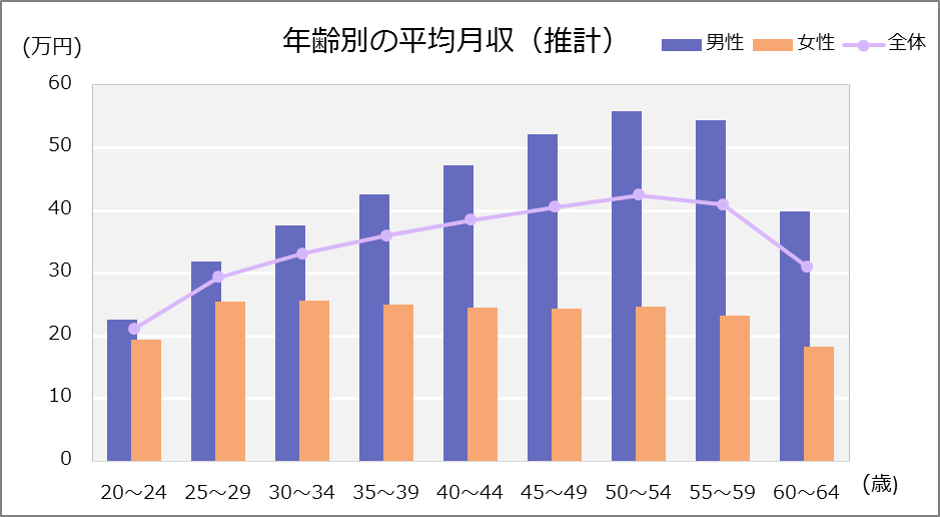

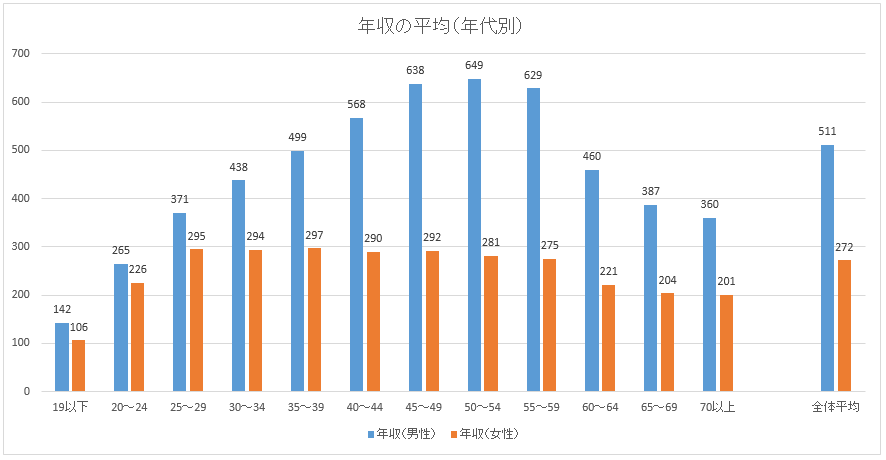

Below is the average salary over all sectors of the economy, broken down by sex and age. You’ll find a lot of graphs on the internet like this however the following is from ten-navi.com and comes up as the top search result for ‘average salary’ in Japan.

So the average monthly salary for a 40 year old man in Japan is about ¥460,000 before tax. There is a whole blog post and more to say about why the ‘wage gap’ is so large in Japan, but that is for another day.

Not on counting large numbers in Japan

Large numbers use a different separator compared to the west. The most common is 万, which means 10,000 and is the largest banknote in use (stuff a load of those in your wallet and feel rich). So 5万 means 50,000. 50万 means 500,000 (50 ten-thousands or 50,0000), etc. A good way to remember at a glance is that: –

1-9 万 is expensive clothes or decent hotels

10-99 万 is monthly salaries

100-999 万 is yearly salaries or cars

1000-9999 万 is the price of houses

Anything above that you aren’t ever going to deal with.

Here is another graph from news.livedoor.com that is based on tax returns information from the Japanese government.

So the average yearly salary for a 40 year old man is about ¥5,680,000. The two graphs so far seem to match up fairly well, so perhaps this data is true. The data includes any bonus. Bonuses are usually 1-2 months salary depending on the company and employee, and usually given out twice a year. Many jobs will not have bonuses, and the bonus system is so entrenched in Japanese business that regular monthly salaries have shifted lower over time to compensate. Think of the Japanese bonus as “performance adjusted part if your salary” rather than a bonus “on top” of your regular salary. Bonuses are adjusted for the companies financial results and your performance in appraisals based on targets set last period.

Of course, when first coming to Japan you get the salary you are given (usually). So none of the above really matters, especially if you are not on a contract that includes bonuses. There is also a certain amount of evidence that foreigners are often paid less than Japanese counterparts.

Regardless of how you come about your salary, the above data gives you a rough yardstick to compare yourself to the average.

Tax and other fixed deductions

Japan has 4 main deductions. Income tax, resident (local) tax, health insurance and pension. As a foreign resident, you may or may not have to pay some of these. A great little site is japantaxcalculator.com, which I have tried and is very accurate, will calculate your take-home pay if you set your yearly salary at the top.

Income tax

Income tax is actually a more complicated calculation that the table below, and it can be adjusted at the end of the year depending on your deductibles, such as dependents, capital gains/loses, etc. However, roughly it is the following: –

| Annual Salary | Tax Rate |

|---|---|

| 0 – 1,950,000 | 5% |

| 1,950,001 – 3,300,000 | 10% |

| 3,300,001-6,950,000 | 20% |

| 6,950,001-9,000,000 | 23% |

| 9,000,001-18,000,000 | 33% |

| 18,000,001 + | 40% |

Japan has a progressive tax system with a tax-free portion. If you don’t know what that is, go and read about it on Wikipedia.

Residence tax

You will need to pay a residence tax, which is split into city and state (prefecture) tax for a total of 10%. You can read more about it here. I wouldn’t bother delving too deep into the calculations as it is all handled automatically once you register with a ward office. You get a pass the first year you are in Japan as the Japanese system needs a year of data before it can figure out how much you owe. Why Japan can’t do what other countries can do is a mystery, but it means foreign residents get away with not paying local tax for the first year.

You may have this tax paid automatically via your employer, or it may come as a set of invoices you pay at a convenience store, split into monthly payments. Usually they send a year’s worth all at once so it can be a bit of a shock, but payment is always in smaller portions; you just pay the one for the month you are in and save the rest of the sheets for later. You can pay it all at once if you like.

Health insurance and pension

Here is an example of how much you pay for health insurance and pension, should you be signed up via your employer. You are placed into the combined health insurance and pension pool, which is a total of 18.3% of your salary, only half of which you pay yourself (your company pays the other half). So you pay about 9.15% (2019 numbers – if you read this in the future it will almost certainly be higher).

If you don’t have an employer who is required to offer the combined insurance, then you can sign up to the basic health insurance and pension directly from the local ward office. Pension is set at ¥16,410/month (for the fiscal year 2019). The health insurance contribution calculation is nightmarishly complex (page 12 of that PDF) so it’s very difficult to actually find a document that gives a rough % value. Here is a calculation site that allows you to figure something out in advance. You should input your entire family as the calculation is based on a household and not the individuals. Basically, you will get stuck with a bill for around 6-10% of your salary if you pay the health insurance yourself. Most people wouldn’t pay the 10% level as that would mean a salary of 6mil yen. If you are on that kind of salary you will probably be in the employee scheme, which is cheaper.

Other deductions?

You may have to pay extra depending on your employer. Some companies have cooperative fund schemes, which are usually a few thousand yet a month and allow for emergency loans, etc.

You can also “top up” your health insurance to avoid paying the 30% that is not covered by the insurance (if you have a bad health issue such as cancer that 30% you have to pay starts to get painful).

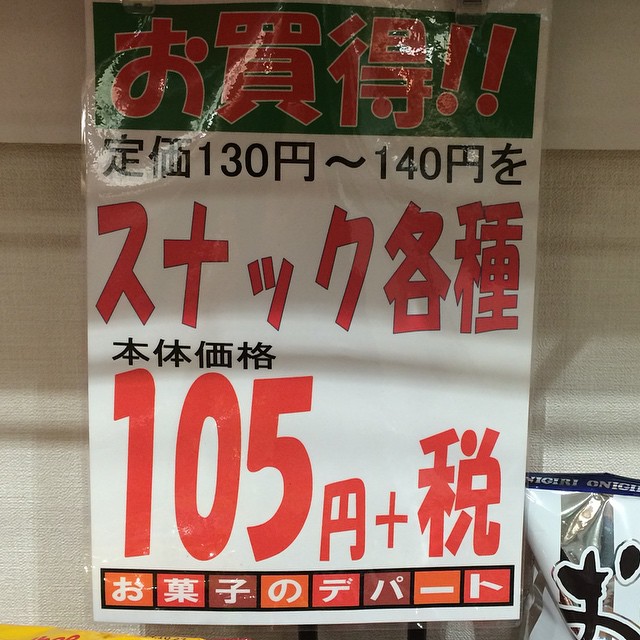

Consumption tax

Finally there is the (as of October 2019) 10% consumption tax on almost all goods and services (depending on the type of goods, the 8% remains – see here for a good explanation). If you are from Europe, this seems like a bargain. From anywhere else in the world, what a rip-off. Regardless, all prices have this included so it isn’t really something to factor into your salary.

Pro tip: You are supposed to pay 10% while eating-in at the convenience stores, however no one checks.

So listed above are all the deductibles for your salary. Now you know roughly how much you will be taking home, right? What do you spend that money on?

Renting in Japan

Most foreigners in Japan will rent. Ignore the horror stories of foreigners being discriminated while hunting for apartments (short version – they are, but not as bad as you might think). It may be you, may not. Pick your fight or walk away, the choice is yours, newbie to Japan who doesn’t speak Japanese.

Rent in Japan is complicated and depends on the following factors: –

- Location (obviously)

- Near popular locations will increase the price

- Area (in m2) and floor number

- There are numerous configurations of apartments and associated area. Pay more for more!

- Ground floor is cheaper as it is less secure.

- Distance from a station

- No one wants to walk more than 15 minutes. If you have to get a bus to the nearest station, the price drops a lot.

- Age of the building

- No one likes to live in anything before 1980

- Type of construction (wood, concrete, etc.)

- Anything less than reinforced concrete means you’ll hear the neighbors.

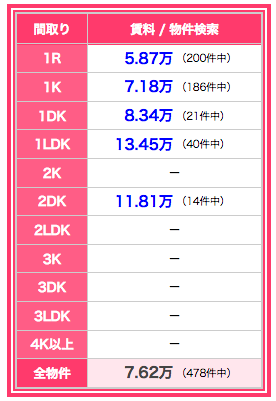

So, depending on what you are willing to put up with, your rent will vary widely even in one area. However, as a roughly guide, this website is fantastic. The original is only in Japanese however with Google translate, it is functional. Click on the map or use the links at the bottom, and then click on the sub-area to get a breakdown of average prices. You may need to flick back to the “original” version as the Google engine doesn’t translate “万” correctly so you may end up with silly values. Basically, all rent is written using the character for 10,000 as the unit.

万 mean ¥10,000 so 5.87万 is ¥58,700.

- 1R = 1 room (studio apartment) usually <20m2

- 1K = bedroom and (very small) kitchen. 15-25m2

- L = Living room, D = Dining Room, K = Kitchen

- 1DK and 1LDK will be between 25-50m2

- Anything up to 3DK level can be up to 100m2

So in the example from Suginami Ward in Tokyo, a standard 1K apartment, around 20m2 and an average set of qualities like age, distance from the station, etc. will cost about ¥70,000 a month. I live in Suginami and that is exactly what I am paying, so this site works fine. I checked other areas and the number look right based on my experience and that of other people I know.

So now you know exactly how much you will be paying for rent, once you know where you are living and how big an apartment you want.

Traveling to work

Usually your travel expenses will be paid by your company and given back to you via your salary, even in low payed jobs. However, if you aren’t so lucky, you can figure out your costs by using Hyperdia.com.

Other expenses

No one knows what you spend your money on in terms of food and entertainment, however a few items are generally required for modern living.

- Mobile phone – generally around ¥4000-8000 for a good data plan plus handset

- Electric, gas, water bill, etc. – around ¥3000 a month for each

- Internet at home – around ¥4000 (sometimes free with the apartment)

So you will be looking at around ¥20,000 for bills a month, if you aren’t scrimping and saving. If you want to budget in eating out, then between ¥1,000-¥2,000 is a decent meal in Tokyo, but <¥1,000 is perfectly possible. The cinema is currently a rip-off ¥1,900 in Tokyo (it went up recently from ¥1,800 as of 2020). A standard beer while out drinking is about ¥500-¥600. Use those numbers as a way to figure out how much you might spend a month.

So what do I have left? An example…

There are two types of questions asked in general: –

- For <insert number> salary, can I live a good life in <insert location>?

- If I live in <insert location>, what salary do I need for a good life?

For people of the 1) persuasion, do the following: –

- Figure out your pay after all deductions

- Look up the rent you will be paying

- Add the bills and adjust if needed

- See what is left for a “good life” (see below)

If you are number 2), then do the following: –

- Look up the rent you will be paying

- Add the bills and adjust if needed

- Add what you think is a “good life” (see below)

- Workout your salary from that

And then you will have your final answer. How you lead your life is something no one else can guess so convert what you have left from your salary into a daily value. If you have ¥20,000 – ¥30,000 a week left over to play with, you can survive anywhere in Japan, but you might have to cut back on lifestyle choices and eat cheaply (Matsuya, Yoshinoya, etc). Anything above that and your extravagances can increase. If you get to ¥50,000 a week or above; well done, you have won Japan! You can survive easily and save a much as you want to. Anything less than ¥10,000 and you will find things really tight, will be avoiding buying anything and eating cheaperly all the time.

Most single people survive fine on a monthly salary of less than ¥300,000. The hourly wage in Tokyo for store workers is only about ¥1,100 an hour, so if you are working 40 hours a week your monthly salary is ¥176,000 before tax. If you take that as your standard candle, anything above that is working your way up to comfortable status. Once you get to ¥400,000, you can live life easily as a single person, but might have to be careful if you have a family. Once you are above ¥600,000 a family will become much easier, and above ¥800,000 you can lead a very good life even with a family of all dependents.

Additional Resources

This site is made for first time teachers to Japan and gives you an excellent breakdown of costs. The “savings” value seems a bit high so perhaps cut that in half for something more realistic.

What things doesn’t this guide include

If you go to the doctor a lot, then that 30% deductible for the health insurance will add up. This guide also does not go in any details about how your tax and insurance/pension gets adjusted if you have a family, investments, two jobs, etc. It gets really complicated so it is better to sit down with your companies HR department and figure it out. If you don’t have a company HR department, probably you have nothing to worry about.